If you are a crypto trader or an investor then you might have wondered whether to file taxes on the returns that you made out of your crypto trading or not. For those who are not clear about this tax thing with crypto assets, try to understand that filing taxes for the capitals that you gained through the crypto trading is mandatory. Most of the exchanges don’t even inform their users about this 1099 form and also even normal tax filing websites don’t ask about your crypto assets while calculating taxes. It is to be noted that these online platforms are still in the process of trying to include crypto assets into the tax calculation system. This delay in the process is because of improper rules and regulations for crypto trading in various countries. There is still confusion among the governing bodies to frame rules for this kind of assets. So now it is all in the hands of the individuals to know about the new taxes and take care of it.

If the Internal Revenue Service (IRS) finds that you are not paying taxes for your crypto assets then you have to pay a “substantial understatement” penalty and “negligence or disregard of the rules” penalty which itself is 20% more than the original tax. Moreover, if they find out that you purposely did not pay tax, then the penalty is 75% of the overall gains. So it’s better to stick to the rules and pay taxes regularly.

Don’t think that one can’t able to track the trading transactions in Crypto world because once FBI was able to track $13.4 million in Bitcoin from the Silk Road to its anonymous founder, Ross Ulbricht, by tracing public transactions on the blockchain which was way back in 2014s.

In Country like the USA, cryptocurrencies are treated similarly to stocks which means one has to pay overall capital gains out of the overall trading gains/losses to the government. Also if you are a crypto miner or an individual who gets paid via cryptocurrencies then you have to pay basic income tax.

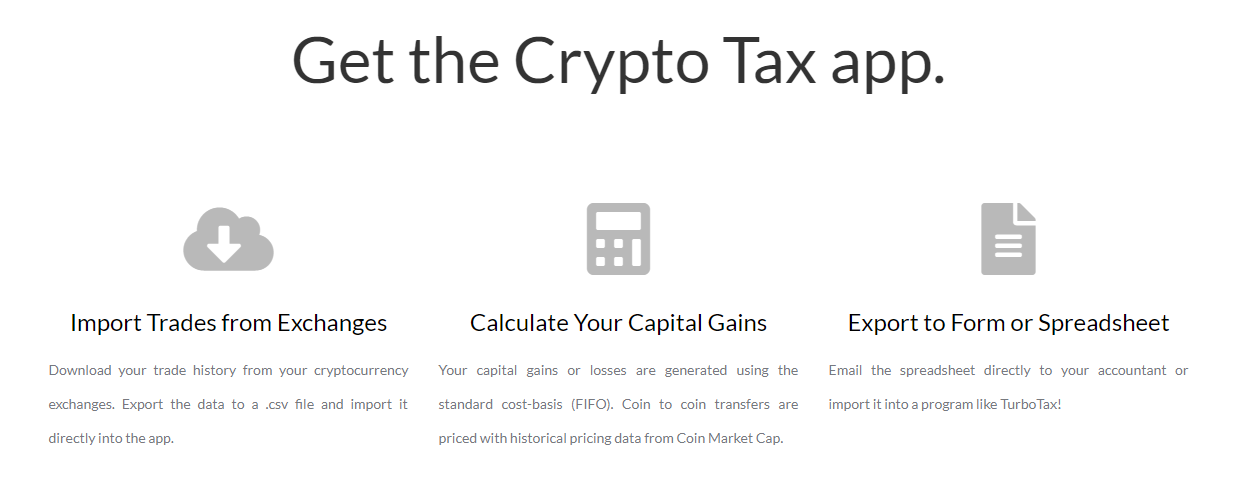

Now I can understand that you are thinking about where to get the information about this taxes on crypto. In order to make you work easy, try using this web application recently launched by GetCryptoTax for calculating the taxes for your crypto assets.

About GetCryptoTax

This company founded in 2018, is a pioneer in preparing crypto taxes for your assets using their web application with a rich user interface. Ian Hafkenschiel, expert of crypto trading formed this company when he saw the growth of cryptocurrencies and realized the importance of creating a tool for managing the tax calculation for traders. GetCryptoTax’s web application uses excel spreadsheets for fetching your trading data from the exchanges for the tax filing process.

Features of GetCryptoTax

1. Rich User Interface

GetCryptoTax web application provides a rich slickest user interface for the users to use the application smoothly.

2. Click-by-Click Tutorial

This application is designed in such a way that the process of filling the taxes is guided with the help of a click by click steps of the tutorial. Even an individual with less technical knowledge can get through the filing easily because of this feature.

3. Highly Secure

GetCryptoTax is not using any APIs for fetching your trading data from the exchanges. The main reason for this is that if an application is using APIs means then there are more chances for the application to gain access to your account and could potentially trade with your crypto assets. In order to avoid this thing, GetCryptoTax uses normal excel spreadsheets for retrieving all of your trade data from your exchanges. That’s how this web application is more secure.

4. Capital Gains Calculation

There is an option to calculate your capital gains or losses using this web application. It is calculated based on standard cost-basis (FIFO – First In First Out basis). And also even coin to coin trading is taken into account with the help of the historical data available in the Coin Market Cap.

It is recommended to use the GetCryptoTax application for taking care of your tax calculation for your crypto assets because of its cheap, user-friendly and highly secure application.

Why waiting when the deadline for tax filing is very close? Go to GetCryptoTax before it is too late.

Thank you for reading our article and if you have any doubts/queries/suggestions, please feel free to comment below. If you find this article useful and knowledgeable, please share it with your circle. You can even contact us privately through the contact form or through social networking sites like Facebook, Twitter, Google+ etc.